1. Challenges Faced by Today’s Web3 CFOs

The FTX incident has exposed serious financial issues within the Web3 industry, including the misuse of a significant amount of user funds. Moreover, the financial reporting mechanisms are inadequate, with many Web3 companies lacking financial reports. There exists a significant gap between traditional auditing and digital asset auditing.

For Web3 CFOs, financial information is difficult to organize, scattered across multiple data sources on-chain/off-chain. There is a lack of knowledge regarding the treatment of digital assets under accounting standards and the definition of fair value, leading to difficulties in their work. This results in non-transparent disclosure, inconsistent calibers, and untimely reporting.

2. The Role and Responsibilities of Web3 CFOs

As digital assets are adopted on a large scale, the financial, accounting, and taxation affairs of Web3 will also increase day by day. There is an urgent need for automation of daily repetitive work, and the lengthy and complicated data processing needs to be replaced by software. Different chains and a variety of tokens (digital assets holdings) will be the difficulty in on-chain financial processing.

Daily repetitive work of Web3 CFOs:

1) Daily operations: Issuing salaries, reimbursing operational expenses;

2) Compliance: Web3 CFOs aim to make the enterprise more transparent and trustworthy. They are committed to visualizing financial data, timely monitoring the level of financial health, and also responsible for meeting accounting, tax, and other compliance requirements;

3) “Timely Rain” = Chief “Strategy” Officer (CSO): Beyond controlling costs, the presence of Web3 CFOs also has a strategic role, such as seeking new business profit points, timely reducing business lines with unsatisfactory profits, and providing the most timely strategic adjustments for the enterprise from the perspective of cash flow.

3. Cryptocurrency Wallets and Custody

In the Web3 world, cryptocurrency wallets and private keys are akin to bank vaults in traditional finance.

“With no key, there are no coins; coins and keys are unified.” To receive cryptocurrency through a wallet, a public key is needed. Wallets can be divided into cold wallets and hot wallets, as well as hybrid wallets, and can also be classified into multi-party computation (MPC) wallets and multi-signature wallets.

Regarding cryptocurrency wallets and custody:

Elven, a Web3 CFO, recommends using different wallets for different purposes to facilitate management and diversify risks. Choose hot wallets for financial operations, cold wallets for storage, and multi-signature wallets for layered management, etc. Different wallet technologies should be applied to different use cases.

Try to store large funds on self-custodial platforms to prevent potential risks associated with centralized platform custody, such as liquidity crises, unexpected freezing by the Supreme Court and government, hacking attacks, and external intrusion risks.

Daily maintenance:

1) Keep records for each wallet.

2) Be aware of network risks; for example, phishing emails.

Take local precautions; for example, install anti-virus software.

4. Fiat Bank Account Management

Organizing the company’s entities and managing bank accounts have become crucial parts because of the regional mix of “compliance licenses + merchant resources.” Timely organizing the entity information and finances of accounts can help plan operations in different regions, such as preparing the financial reports of parent and subsidiary companies in time to apply for or extend the licenses of the operating locations of the parent and subsidiary companies and meet other compliance requirements.

Only by properly organizing the different entities of the company and preparing materials can one smoothly apply to fiat banks for account opening, to meet future fiat payment needs and fiat financial operations. Even for crypto-friendly banks, KYC and AML are essential. For example, company business, main products, flow of funds need to be disclosed, as well as turnover, financing limits, expected account transaction volume, number of international transactions, monthly transaction volume, etc., all of which need to be reported to the bank for account opening.

In summary, fiat banks still play a crucial role in the current development process of Web3, so the management of fiat bank accounts and financial operations are also crucial aspects that Web3 CFOs must pay attention to.

1) If traditional banks tend to be strict about opening accounts for Web3, you can also try to open accounts in NBFIs (Non-bank financial institutions), Fintech Banks, or Neobanks, such as Revolut, etc. However, ensure that the platform for opening accounts is diversified to avoid bank runs and systemic risks, as well as the synergistic impact of major events. 1) By region, 2) By country, 3) By type of institution: custodian, centralized exchanges, crypto-friendly banks, wallets, etc.

5. Fund Transfer Channels

The topic of “how to exchange digital assets” inevitably involves the fund transfer channels (On&Off Ramp).

Ramp generally refers to various payment gateways, but their goal is to facilitate the exchange between fiat and digital assets.

There are many paths for exchange, and the market participants are increasing day by day, for example, Robinhood, Revolut, Stripe, which are relatively large support institutions. The role of fund transfer channels also includes providing liquidity, acting as counterparties or bridges for many transactions. At the same time, over-the-counter (OTC) transactions are also considered part of this category, with OTC desks undertaking the work of exchange; typically, the OTC business of centralized exchanges also provides liquidity to the crypto market to facilitate the normal operation of funds in the Web3 world.

The operation of fund transfer channels is somewhat complex, especially for institutional users, and there are risks of fraud and AML in the entire process.

Regarding fund transfer channels:

1. Choose reliable fund transfer channels (licensed and compliant), and conduct due diligence (DDL) before selecting a provider.

2. Do not let funds stay in the fund transfer channels for a long time. In other words, do not always exchange cash for bridge tokens and stay in the window period for too long, like the TerraLuna event.

3. Establish a complete mechanism to monitor decoupling and liquidity risks.

If relying on bridge tokens (e.g., stablecoins), it is essential to regularly check the asset proof of such tokens to assess their liquidity and thoroughly understand the operating mechanisms of such currencies. For example, USDT is backed by US Treasuries and traditional assets, posing a smaller risk exposure. However, some stablecoins are pegged to digital currencies or other equivalents. Considering the fair value pricing logic of digital assets and other equivalents is not recognized by the market and the fair value fluctuates greatly, it is considered that such bridge currencies themselves have a relatively large systemic risk.

Emphasizing the diversity of solutions, choosing multiple providers can make the entire operational system more robust. However, it also means spending more time and energy managing these different channels.

6. Cross-border Cryptocurrency Payments

As the CFO of a Web3 company, the previously mentioned processes of bank account opening, fund transfer channels, and the exchange between fiat and digital currencies are complex and time-consuming. What about direct cryptocurrency payments? This could save a certain amount of capital cost while speeding up the payment process.

Scenarios where cryptocurrency payments might occur in financial operations:

1) External: Web3 company as a seller: Issuing bills and invoices for goods and services provided to customers.

2) External: Web3 company as a buyer: Daily expenses, payments for purchasing goods, and subscribing to related services.

3) Internal fund flows: Salaries, equity, and token distribution.

4) Internal: Submission, approval, and reimbursement of travel expenses (T&E), company benefits distribution, airdrops.

You might be wondering about these scenarios, which will be explained in detail later.

1) External: Web3 company as a seller: Issuing bills and invoices for goods and services provided to customers.

Cryptocurrency Invoicing:

This is often provided to crypto-native companies, which may have the vast majority of their funds stored in digital currencies.

This process simplifies the invoicing process, meets the operational and compliance needs of businesses accepting cryptocurrency payments, and can automatically provide invoices to customers periodically — weekly, monthly, or even split bills for streaming payments. It also arranges email reminders to prompt customers to make payments.

Such automated processes can efficiently prompt payments while greatly reducing the company’s cash flow pressure and managing accounts receivable effectively.

These invoices serve as definitive proof. If your company is suspected of money laundering or subjected to tax audits, these documents are essential for endorsing your business, accepted as valid evidence by current systems.

All wallet addresses can be transparently associated with real-world identities, helping your company build corporate credibility, better promote business, and facilitate automated bookkeeping.

2) External: Web3 company as a buyer: Daily expenses, payments for purchasing goods, and subscribing to related services.

About Streaming Payments:

Recommended reading: Streaming Payments: A New Paradigm of Payments Enabled by Blockchain

Some DAO communities, possessing native tokens or self-raised funds, as crypto-native enterprises, might prefer using digital currencies for daily expenses.

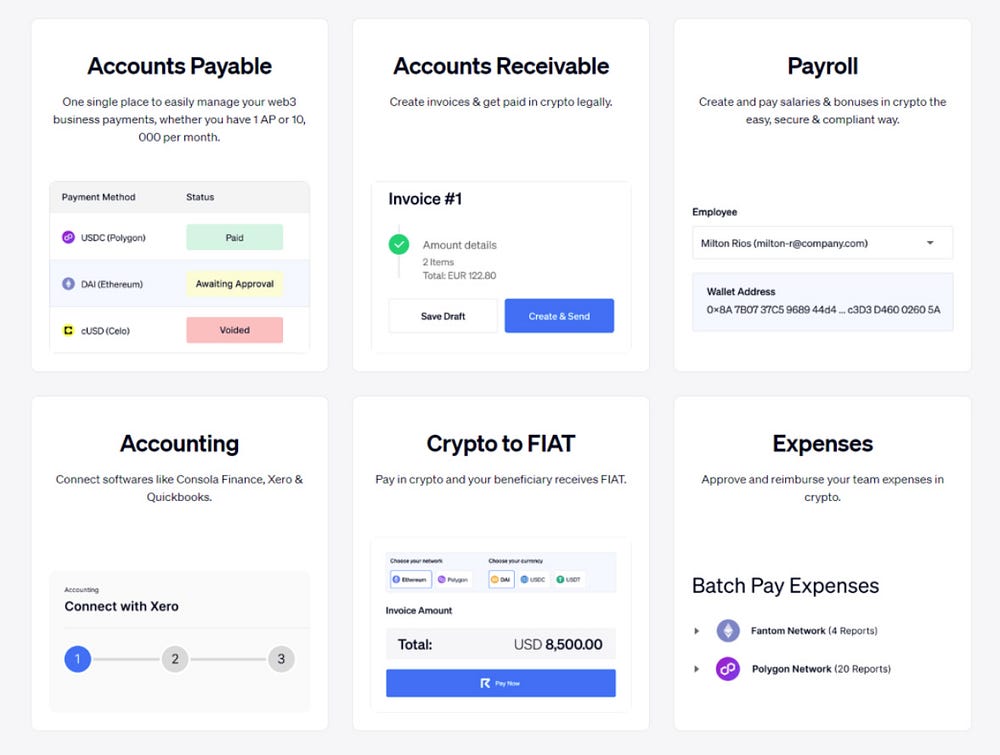

Crypto Invoice: e.g., Request Finance

3) Internal Fund Flow: Salaries, Equity, and Token Distribution.

In the post-pandemic era, hybrid and distributed workplaces have become popular, and given the nature of Web3, most Web3 businesses operate globally with employees distributed across different countries and regions.

Stablecoins offer quick, low-cost, and global payment capabilities, allowing for payments at any time and place. Therefore, paying salaries in stablecoins can be the best option for Web3 companies. But how can a robust cryptocurrency payroll system be established?

Solutions like Deel and Remote.com already exist on the market, but their downside is they are currently only open to U.S. citizens and require an account with Coinbase.

Request Finance is a more mature service provider, supporting salary payments in over 150 different tokens, with more than 14 different payment channels, enabling the disbursement of salaries to hundreds of people with a single click. This system also maintains comprehensive payroll records for review.

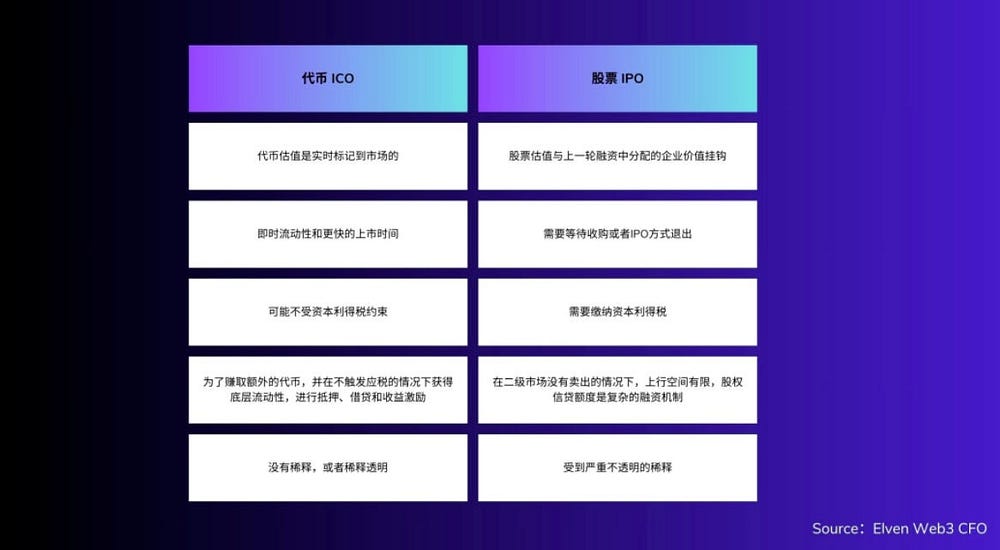

Token Distribution: Token distribution is part of an ICO. It serves as a mode of employee incentive for Web3 companies and also a form of dividend for shareholders.

Areas to pay attention to in this part include:

① Salary tax and withholding tax on token holdings (if any, varies by region)

② Daily accounting and tracking of net income based on tokens

③ Ensuring possession and retention of corresponding compliance/tax law documents

④ Controlling the progress of regulatory reporting/tax filing process

4) Internal: Submission, approval, and reimbursement of travel and expenses (T&E), company benefits distribution, airdrops.

Reasonable corporate expenses can offset some taxes, and cryptocurrency payments can solve the automation of reimbursements. The characteristic of streaming payments is that it does not require batch one-time large transfers; it might be in installments, continuously paying, which greatly promotes the speed of reimbursement and reduces the pressure on employees to advance funds, protecting employees’ cash flow pressure to the greatest extent.

Of course, the scope of T&E is broad, including conference tickets, sponsorship event fees, etc.

7. Capital Management

For Web3 CFOs, the strategy for financial asset allocation and management aims at: capital preservation, liquidity, and income.

The order of priority is as mentioned.

Strategy recommendation: Diversification is key, and cash is king. Pay attention to the recognition and market perception of token models, avoiding holding too many tokens that are either pegged or based on speculative narratives. Preferably maintain a large holding in mainstream tokens primarily BTC/ETH to ensure a comfortable level of cash flow each month. It is also crucial to identify tokens with valuation bubbles, invest cautiously in primary ICO projects, and ensure a quick capital turnover. Hold a certain proportion of stablecoins pegged to traditional assets like USDT, while also ensuring a certain proportion of fiat holdings for risk hedging.

8. Compliance and Reporting:

Financial reporting must comply with relevant laws for recording cryptocurrency transactions for tax and anti-money laundering (AML) purposes.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish