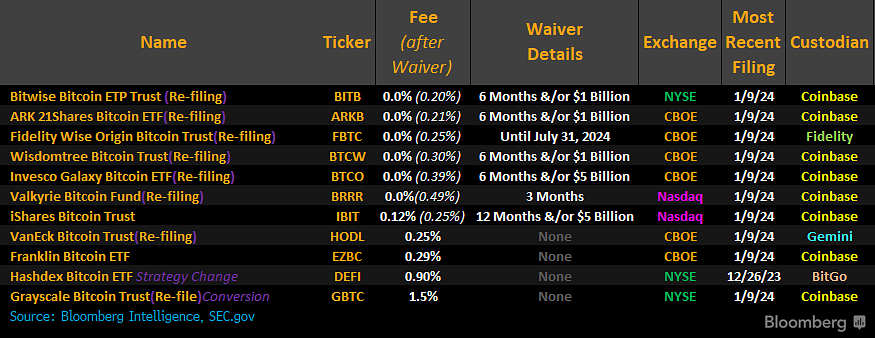

On January 10th, US time, the US SEC announced the approval of the Bitcoin spot ETF. After several mishaps, including the premature release of the approval information due to the US SEC’s official Twitter account being hacked just the day before, the Bitcoin spot ETF has finally been fully approved. The specific list and details are as follows:

It’s noteworthy that, due to expectations for the spot ETF, Bitcoin’s trend has deviated from that of the Nasdaq. According to data tracked by research provider Fairlead Strategies, the 40-day correlation between Bitcoin and Nasdaq is currently zero, indicating a lack of correlation between the asset classes. Since early 2020, the correlation between Bitcoin and Nasdaq has been positive, reaching a peak of 0.8 during the 2022 cryptocurrency bear market. The core reason is the external expectations for the spot Bitcoin ETF.

Unusually, Bitcoin showed little fluctuation in the 24 hours before and shortly after the announcement. In contrast, Ethereum surged in the preceding 24 hours, reaching a 19-month high and even driving other Ethereum concept tokens to surge. This article will review the impact of the Bitcoin spot ETF and whether the much-anticipated Ethereum spot ETF will pass.

In the statement, the SEC Chairman pointed out:

The U.S. Court of Appeals for the District of Columbia held that the Commission failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed ETP (the Grayscale Order). Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares. Today’s Commission action is cabined to ETPs holding one non-security commodity, bitcoin. It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities. Nor does the approval signal anything about the Commission’s views as to the status of other crypto assets under the federal securities laws or about the current state of non-compliance of certain crypto asset market participants with the federal securities laws. Without prejudging any one crypto asset, the vast majority of crypto assets are investment contracts and thus subject to the federal securities laws. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.

Full Statement:

https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

Cobo founder Shen Yu pointed out that this will create a new channel for traditional financial funds to compliantly enter the cryptocurrency industry. In 2024, we need to pay attention to the following: the changes in asset size after the ETF approval; the emergence of derivatives based on the ETF; and the implementation and development of asset management in various countries after the ETF approval. In addition, we should also focus on whether the approval of the Bitcoin ETF will extend to other cryptocurrencies such as Ethereum.

Shen Yu’s Review and Outlook: What Else is Worth Paying Attention to After the 2024 Bitcoin Spot ETF?

An analysis article by DigiFT pointed out that the United States is one of the largest financial markets, and the listing of Bitcoin spot ETFs on mainstream exchanges can reach qualified investors, institutional investors, and retail investors simultaneously. Products like GBTC, which are structured as trusts, are only traded by qualified investors in the OTC market. Similar Bitcoin spot ETF products in Europe, Canada, and other regions have poorer liquidity and smaller capital scales compared to the U.S. market. Traditional asset management departments, such as fund managers and financial advisors, find it difficult to include cryptocurrency assets in their portfolios without a Bitcoin spot ETF. Bitcoin spot ETF products issued by institutions like Blackrock and Fidelity will be more easily accepted by mainstream funds due to the endorsement of these institutions’ brands.

Bitcoin Spot ETF Approaching: Reviewing the Current Status of Compliant Cryptocurrency Investment Products and Their Impact After Approval

Standard Chartered Bank has given an extremely exaggerated expectation: If the spot Bitcoin ETF is approved, it could attract $50–100 billion in capital inflow in 2024. This would push the price of Bitcoin to reach $200,000 by the end of 2025. The bank reached this conclusion through a comparative analysis of the spot Bitcoin ETF and gold ETF. Standard Chartered also predicts that the SEC will approve the spot Ethereum ETF in the second quarter of this year.

Asset management giant VanEck released its prediction for 2024, believing that over $2.4 billion will flow into the Bitcoin ETF; Bitcoin will hit a new all-time high in Q4 of 2024. Valkyrie expects $200–400 million to flow into its ETF in the first week, with $4–50 billion entering the market in the first few weeks of trading.

Galaxy research believes that the Bitcoin spot ETF provides broader coverage for both retail and institutional investors. The range of available BTC investment funds is limited, mainly driven by wealth advisors or offered through institutional platforms. The ETF is a more direct regulated product, increasing access for a larger group of investors (including retail + affluent individuals). ETFs can be accessed by a wider range of clients, including direct brokers or RIAs (Registered Investment Advisors), without relying on wealth managers. It also predicts that with 10% of available assets adopting BTC, averaging 1% allocation, the inflow into Bitcoin ETFs in the first year after launch is estimated at $14 billion, increasing to $27 billion in the second year, and $39 billion in the third year after launch.

Galaxy Research: How Big is the Market Size of the Bitcoin ETF? What Wider Impacts Will It Have on Bitcoin?

BitMEX co-founder Arthur Hayes, known for his blog writing, has consistently presented unique perspectives. He acknowledges that if a US-listed spot Bitcoin ETF begins trading, the expectation of tens of billions of dollars in fiat currency flowing into these ETFs could drive Bitcoin past $60,000 and approach its 2021 peak of $70,000. However, he also believes that a 30% to 40% correction is easily foreseeable in March this year due to issues with US macroeconomic policy. Additionally, he thinks that if the BlackRock ETF becomes too large, it could actually pose a threat to Bitcoin, as it would represent a large quantity of non-circulating Bitcoin. If upgrades are needed to enhance privacy and encryption to ensure Bitcoin remains a robust, cryptographic monetary asset, these interests may not align with those of traditional financial institutions. Which upgrades institutions will support remains an unresolved question.

Full text of Arthur Hayes Podcast: Is the Bitcoin Spot ETF Really a Good Thing?

Blofin analysts believe that the approval of the ETF may lead to a brief market boom. However, once this initial optimism is realized, the market may lose momentum. Funds might flow into the ETF, but this movement is more of a medium to long-term process and unlikely to attract substantial capital in the short term. For instance, Canada and Germany already have Bitcoin ETFs that trade directly on the market, but their impact has been limited. Therefore, the hype based on spot Bitcoin might temporarily boost the market, but it could then retreat due to a lack of cash flow. They think the market may experience a brief independent rally post-ETF approval, but this will soon correct due to investors taking profits, market makers hedging, and expectations of future market and macro liquidity. However, the bottom of this correction is likely to be higher than the previous $33,000.

Colin, the chief editor of Wublockchain believes: After reading today’s statement in detail and based on current information, I am more optimistic than pessimistic about the near-term approval of an Ethereum spot ETF, with about an 80% probability. The key is that Ethereum futures have already been approved, similar to Grayscale’s court ruling (if futures are approved, there’s no reason to deny spot approval), and the SEC has succumbed to the aforementioned court decision. Therefore, there’s no reason not to approve the Ethereum spot ETF following similar logic. A negative factor is how the SEC Chairman views Ethereum as a security. During previous Congressional inquiries, he often dodged and did not respond to this question.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish