Source:

https://twitter.com/JinzhouLin/status/1732233990873264271

1、Scale Growth Resulting from Effective Regulation

With Binance’s regulatory episode comes to a conclusion, many perceive it as negative news for the industry — a process of “Crypto’s biggest unicorn ultimately compromising with regulation.” However, from my perspective, it signifies the removal of the biggest potential risk area. The overall industry risk is now manageable, moving towards a regulated market direction. This is expected to accelerate the approval and implementation of ETFs.

Envisioning the future: Currently, CME trading volume constitutes over 25% of the entire BTC Futures (confirming the speculation of significant institutional entry). With the weakening of U.S. regulations, BTC’s trading volume on compliant exchanges like Binance/Coinbase is poised to dominate the market share. We might even witness Nasdaq directly listing BTC and ETH. In such a scenario, one can imagine the daily trading market size of BTC. Amid the U.S. debt crisis, the Federal Reserve and the Democratic Party seem to have reached a consensus on some form of crypto governance. They are likely to play a significant move in the next big chess game. Regulatory collaboration with the crypto market is a positive factor, paving the way for the industry into a broader market.

2、 Data Indicates the Bull Market’s Return

Currently, three events are converging in the coming months:

- The aforementioned accelerated approval and implementation of ETFs (an inevitable event, with Wall Street gaining control over Bitcoin pricing).

- The Federal Reserve’s move to cut interest rates as inflation peaks and falls (given the current U.S. debt situation, interest rate cuts will become a more certain event).

- The halving of Bitcoin production and iterations of infrastructure Layer2 and application innovation within the Ethereum ecosystem.

These three events will occur simultaneously in the next six months, indicating that the industry will rebound from the current market and has the potential to impact a more robust bull market.

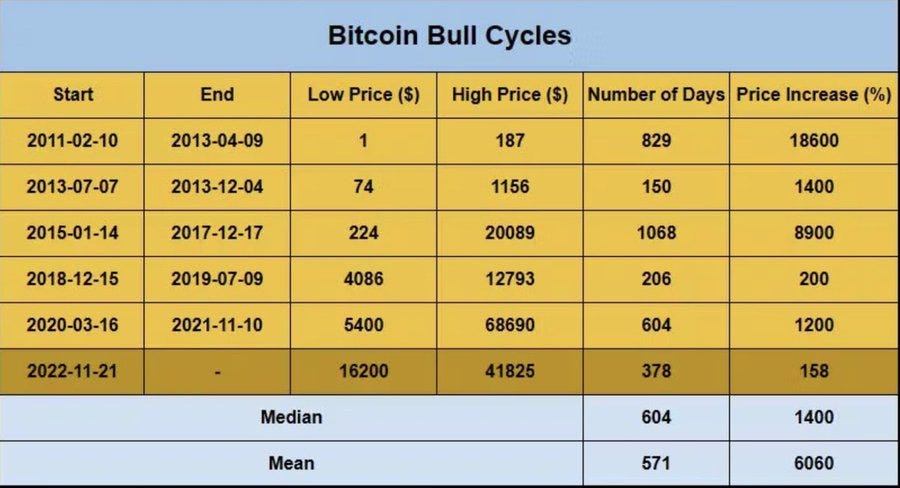

Analyzing historical bull and bear market cycle data (from internal data analyst at IOSG) validates the current market situation. The median decline during historical bear market cycles is around -77%, with an average decline of about -75% (the recent bear market cycle precisely fell by 77%). In contrast, the median price increase during bull market cycles is 15 times, with an average increase of about 60 times.

Regarding the duration of cycles, the median duration of bear market cycles is 354 days, with an average duration of 293 days (the recent bear market cycle’s duration also approaches 354 days). For bull market cycles, the median duration is 604 days, with an average duration of 571 days.

Analyzing historical information is valuable for understanding the cyclical nature of the market. Currently, we are entering the mid-stage of a moderately long bull market cycle and are climbing into the ascent phase of this cryptocurrency bull market.

3、Continuous Ecological Innovation, Ethereum’s Robustness

Regarding Ethereum’s ecological innovation, we cannot ignore the DevConncet conference in November, the most significant gathering of crypto developers this year, featuring Vitalik Buterin appearing frequently in different settings. Let’s review what happened at Devconnect.

Strengthening Infrastructure: New technologies and specific market directions emerged at L2Day, zkDay, and zk Accelerator. Various ZK and L2 protocols showcased their strengths on different stages. Protocols based on zkRollup, including Risc0/Nil Foundation, and Scroll/zkSync/Aztec, began competing after the mainnet launch, presenting a diversified ecosystem.

- The ZK Coprocessor direction is promising, including Axiom, Brevis, Lagrange, and Herodotus. Axiom’s application prospects are straightforward. The main difference between CEX and DEX lies in the Referral Program and loyalty plans. The more users they attract, the more transactions occur, leading to more income and more fee reductions. Axiom hopes that DEX can also have these plans, helping Uniswap track all relevant on-chain interaction data. Calculating each user’s new user acquisition and transaction details trustlessly and securely, providing subsidies.

- Different protocols on the Layer3 and Raas tracks are starting to compete, including Conduit/Caldera/Gelato, launching application chains for games, social, and DeFi. Due to the Israeli-Palestinian conflict, many developers of Jewish background did not attend this conference. Nevertheless, you could still see countless developers and founders continuously promoting their Rollup as a service solution to the market. This is a valuable early market! There was a moment when I sat in a cafe, surrounded by founders of different L2/L3 backgrounds, continuously pitching their solutions on how to better help applications deploy on-chain and provide an industry application experience equivalent to Web2. This feels a bit like the early stages of the Web1.0 market around 2000 and the eve of the massive outbreak of Saas around 2012.Many say that Ethereum’s network innovation is very slow, with many modules outsourced to technical teams of different developer community. However, this precisely validates its strong network effect. The mainstream L2/L3/DA projects mentioned earlier are helping Ethereum address performance and use case issues. Under the competition wave of technical development, seemingly the entire crypto ecosystem, including infra/dapps/vc, has become employees in the Ethereum network. Everyone doesn’t receive a salary but works together to contribute to the network’s growth.

- Recent developments also involve much-discussed technologies like distributed GPU and ZKML. Bittensor’s narrative and rise have shocked many, and in the same field, Gensyn, with a valuation of $500 million in the seed round, has also garnered attention. They are dedicated to bringing decentralized AI computing to users.This hot field is not a castle in the air, with no application scenarios. A game developer once showed me how they combined Crypto with AI. Their demonstration surprised me with the natural and close connection between Crypto and AI. Based on ZKML technology, they developed a fully on-chain football game platform where five people autonomously compete. Each pass and goal are supported by ZKML, and game results are automatically uploaded to the blockchain. Players can set different strategy models (ZKML) for battles (similar to the use of Bot/AI strategies in Dark Forest).Although there is still controversy over discussions and user acceptance of on-chain LLM and ZKML use cases, I believe we will soon witness more AI-centric crypto platforms. Recently, Vitalik also mentioned “d/acc” (decentralized acceleration), and in the future, we will see a new project from Unibot and former Flashbot founder Stephant. This will attract more new users to change their trading habits and start using Bot-based trading methods.

The last direction is back to fully on-chain gaming. I mentioned this direction before and want to share with you a young game genius developer I saw — Small Brain, designing exquisite fully on-chain games like Word3, Drawtech, and Gaul. The designer behind it not only developed many outstanding gameplay mechanics, creating games with blockchain characteristics, but also, with unique insights in the AW community, rallied a group of like-minded developers to rapidly iterate on mud. They are moving towards the goal of launching a new fully on-chain game every six weeks, conducting many interesting experiments.

I think critics of Ethereum overlook its compatibility and evolutionary capabilities, especially when new application products face bottlenecks. Ethereum can quickly absorb new technologies, solve bottlenecks (tps, gas fees), and provide solutions to most issues encountered by applications. New alt L1 platforms, in terms of application scenario segmentation, do not have a clear advantage.

In this cycle, Ethereum has two particularly typical and different network expansion patterns than before.

- The first is the output of currency and “security” through LSD assets, an extension similar to the U.S. dollar. This extends to various Layer2, altchain, restaking protocols, and DA protocols. With the overflow of Ethereum’s LSD, the extension of Ethereum’s currency will greatly strengthen the network effect of Ethereum, making ETH’s moneyness and store of value characteristics more prominent.

- The second is technological absorption and integration. In each cycle, Ethereum absorbs new technical paradigms based on the failures of past new platforms. Whether it’s POS, after four or five years of observation and summary, to its eventual implementation, or scaling — from Plasma, sharding to various rollups — all are lessons learned from many failed projects. In an open-source system, this capability is equivalent to the hundreds of billions of dollars in R&D sunk costs invested by most competitors over the past few cycles, and this is all Ethereum’s investment capital. I believe no platform (including Bitcoin) has benefited as much as Ethereum in this regard. Fortunately, after this cycle, Ethereum has not stopped absorbing and integrating.

Why should we doubt Ethereum? Even in a bear market, countless projects and developers are creating different products and protocols on the Ethereum network. Still, tens of thousands of developers and projects are creating new modules and components for this network, disregarding returns. All Web3 funds and investors cannot avoid investing in the Ethereum ecosystem, meaning that with the current market value of ETH in the hundreds of billions of dollars, they will continue to bet on projects in the Ethereum ecosystem on the scale of tens of billions of dollars. Ethereum will become bigger and more unshakable!

4、The Noteworthy BTC Ordinals Ecosystem

As the market rapidly recovers, Bitcoin, as the pride of the crypto world, has seen numerous Bitcoin ecosystem projects vying for attention with various themes. It is extremely challenging to contemplate Ordinals’ value proposition from the perspective of Bitcoin’s purism, as Bitcoin’s core function is value storage. With Bitcoin gaining broader social acceptance, enhanced consensus, value appreciation, institutional entry, anticipated ETFs, and the Bitcoin halving, among other factors, the flourishing ecosystem is a natural outcome. Whether it’s Bitcoin Layer 2, Ordinals, or other protocol applications, they should first and foremost respect and protect Bitcoin’s core, which is value storage.

The rise of Bitcoin memes and NFT assets is closely related to the anti-VC “fair sales” movement. After all, under VC dominance, retail investors can only get the scraps, with the meat consumed by VCs. In comparison to the ICO era, retail investors entering the valuation threshold are too high (Ethereum’s ICO in 2014 had a valuation of only $23 million). Projects in this category typically have a secondary market valuation of several billion dollars, which is too low for retail investors.

It is this market structure that has led to retail investors initiating the “Occupy Wall Street” movement in the current crypto space. However, this trend itself is unhealthy. During DeFi Summer, there was a surge of “fair sales” projects, but ultimately, “fair sales” turned out to be short-lived pump and dump projects, with various crude forks, from “one-month wonders” to “one-day wonders,” with inferior coins driving out the good.

In the end, after a cycle, there are few “fair sales” projects left, and those that remain for long-term development have been tested and have a well-structured financing model. Long-term projects require long-term capital investment, and “fair sales” that are short-lived make it difficult to support the long-term development of the ecosystem. The reason why mainstream crypto institutions have not followed the Bitcoin technical ecosystem too closely is because there is indeed no substantive technical scalability, and it is more of a retail sentiment call under the “fair sales” label (of course, this does not rule out some institutions and exchanges manipulating such sentiment).

We do not support technical applications that threaten the robustness of the Bitcoin native network. Emotional speculation and pump and dump projects are not sustainable. The BRC20 protocol still has many shortcomings, and as institutional investors, we do not encourage speculation but are willing to support more valuable and meaningful builders, bringing more protocols with ecological value.

Therefore, the crypto market is a large cauldron, and currently, tokens like Ordinals and BRC20 have amplified speculation and price manipulation. I believe many people will profit from it, but when we engage in more opportunistic trading without a driven thesis, we will gradually lose our way, and for the same reasons, we may also incur losses in some projects.

So, if new friends who are ready to enter the market see this post, or if you have family or friends about to start buying in the FOMO sentiment, I hope everyone can do the necessary ideological work and highlight the risks. Encourage them to choose only within BTC/ETH, which is the simplest and least error-prone path. Adhering to principles in investments is very challenging. Speculation and memes have brought wealth effects, but it is essential to not only see these in the crypto market but also step out of speculation and memes to support protocols with more valuable propositions and application prospects. This will be an important responsibility and commitment for industry beneficiaries.

Thanks to Teacher Mindao/Wendy/Fiona for their editing suggestions.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish