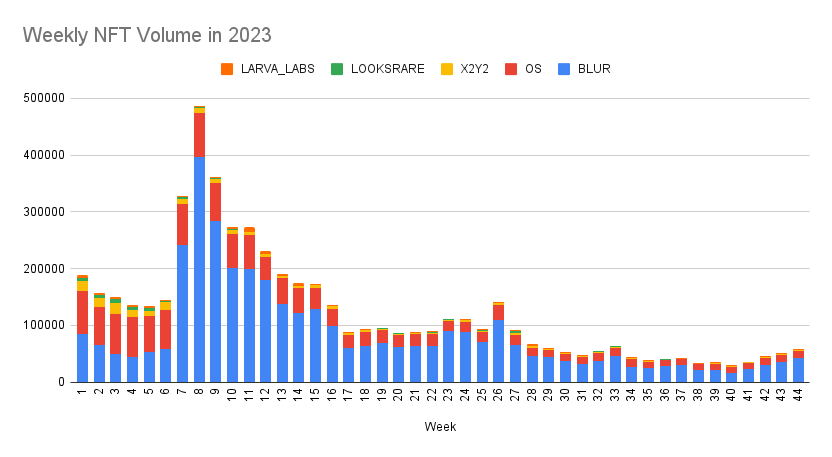

In the past month, as the Crypto market overall has shown signs of recovery, the mainstream NFT marketplaces have welcomed their first four consecutive weeks of positive growth in trading volume for the second half of this year, (a feat last seen from the end of January to mid-February) with trading volumes nearly doubling. This growth is significantly higher than the rise in the value of ETH, indicating an increase in the volume of transactions in ETH. On the other hand, the prices of blue-chip NFTs have also seen a rebound, with BAYC returning above the 30 ETH mark, and Azuki seeing an increase of over 17% in the past month. (Note: Unless otherwise specified, the volumes mentioned below do not include wash trades.)

(Source: https://x.com/punk9059/status/1720431770804371564?s=20)

Under the current market conditions where ETH’s gains are not outpacing those of BTC, ETH holders are reluctant to switch their holdings to BTC. Without taking on explicit leverage, investing in the NFT market has become a better choice. This not only fulfills investors’ expectations of achieving growth in both coin value and ETH value, but it also brings a glimpse of the bull market to the NFT marketplaces.

It is worth reassuring on the resilience of the NFT marketplace; despite the tough market conditions, no large trading markets have collapsed. The commitment to NFTs as an emerging asset class, if viewed from a long-term perspective, may yield returns comparable to today’s CEXs.

The author conducted an analysis of the competitive landscape and strategies of the NFT marketplace in April of this year. Looking back now, there have been no fundamental changes in the landscape. Blur continues to demonstrate strong dominance, but there are also many new forces emerging, such as the OKX NFT Marketplace and Flooring Protocol. Additionally, in response to market changes, some mainstream trading markets have also made many interesting strategic adjustments.

Overthrow and Rebuild, The Failure of OpenSea’s Empiricism & The Composure of Blur

At the beginning of November, OpenSea announced a 50% reduction in staff to adjust the team and reduce middle management, aiming to rebuild its operational culture, products, and technology from the ground up to create OpenSea 2.0. Devin Finzer, CEO of OpenSea, stated that OpenSea 2.0 would be reshaped in various aspects, including underlying technology, reliability, speed, quality, and user experience, and that it would involve a team that interacts directly with users.

The layoffs at OpenSea are essentially a strategic adjustment made in response to the continuous decline in market share and the consequent continuous reduction in revenue, making the rebuild into OpenSea 2.0 appear as a desperate gamble to reclaim market share.

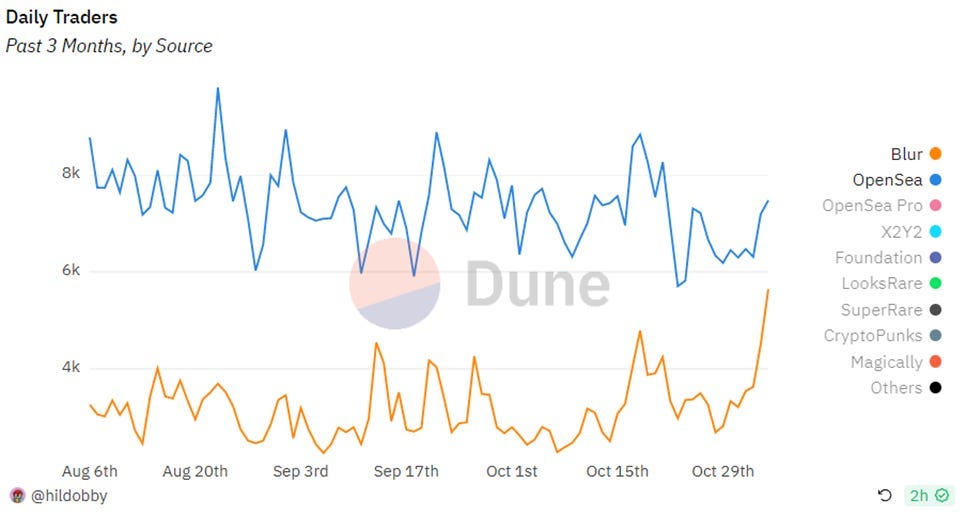

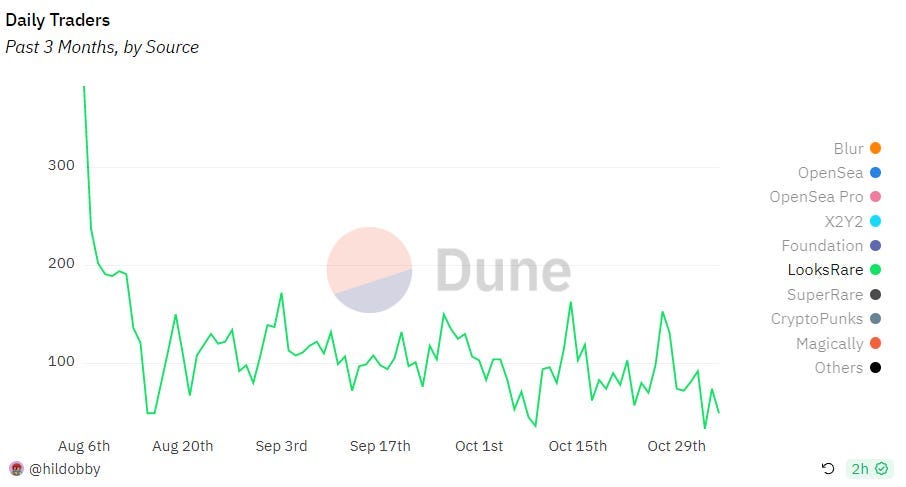

The criticisms of OpenSea can mainly be divided into two types: the product is difficult to use and updates are slow; centralized and the community’s voice is disregarded. However, these points, which are of greater concern to outsiders, may not have been truly recognized internally. Inferring from OpenSea’s recent layoffs, the company, which has survived since 2017, have developed a set of empiricism for survival, which overall tends to be conservative and waiting for opportunities. This set of experiences is closely related to the long period of silence from 2017 to 2020 and the sudden explosion of NFT trading in 2021. Although it cannot be said that there is anything wrong with this approach, it has allowed Blur to continually erode its market share. Especially during the warming phase of the entire Crypto market, not limited to NFT, it is evident that Blur’s rebound momentum is much stronger than OpenSea’s, and the previously double lead in traders is rapidly diminishing. This is a direct challenge to OpenSea’s past empiricism. OpenSea realizes and suspects that past experiences are no longer effective.

(Source: https://dune.com/hildobby/NFTs)

In response to Blur’s impact, OpenSea has indeed made some product responses and community reciprocations, such as launching a more streamlined Offer Wall, imitating Blur’s Bid Pool, and introducing the OpenSea Pro aggregator based on Gem, as well as airdropping NFTs to Gem’s historical users. Unfortunately, these products and community strategies seem more like independent, passive responses rather than being interconnected and lacking in sustainability. The method of using NFT Drops for project launches and community reciprocation was only used this one time by OpenSea.

On the contrary, despite maintaining a long period of social media silence to focus on development, Blur’s product continues to operate methodically. Here, we must discuss Blur’s core moat: individual market makers, which are also the fundamental reason for the ineffectiveness of OpenSea’s empiricism. After the creation of the Blur Bid Pool, Blur introduced individual market makers, which brought strong liquidity, while points and potential airdrops continue to incentivize this behavior. Blur’s individual market makers are primarily composed of NFT OG players, top holders of blue-chip NFTs, and NFT KOLs. They not only possess strong financial resources but also hold significant sway in the community. Their on-chain actions and social media presence subtly influence other NFT players, such as Machi Big Brother, hanwe.eth, and the former BAYC whale, Franklin, among others. They provide liquidity and profit from the spreads around the true prices of assets, and the liquidity they provide makes NFT transactions more efficient and generates more income for creators. While products can be imitated, the chips to win over people’s hearts become increasingly expensive.

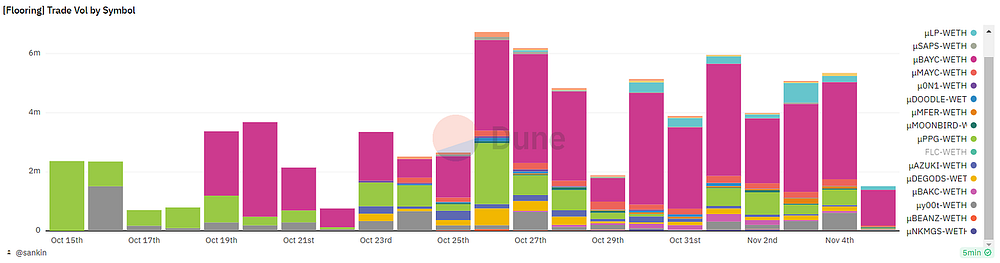

The existence of individual market makers is precisely why Blur appears so composed when facing challenges from new entrants like Flooring Protocol. Flooring Protocol is a liquidity solution that fragments NFTs into ERC-20 μTokens, launched by the NFT OG player FreeLunchCapital. With the incentives provided by FLC, Flooring’s daily average volume ranges from 4 to 6 million dollars (excluding FLC, only including the μTokens after NFT fragmentation).

(Source: https://dune.com/queries/3151047/5268010)

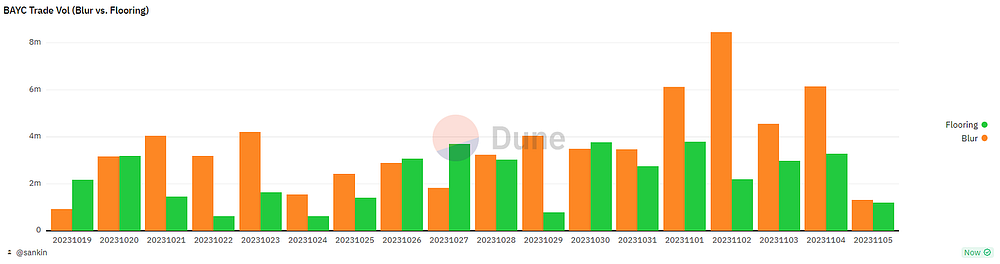

Due to not being fully suitable for long-tail assets, Flooring has implemented a quasi-whitelist permissioned access system. Comparing with BAYC, which has the highest volume, it can be seen that the liquidity and volume guided by Blur’s Bid Pool and individual market makers are not inferior to the μTokens applied in AMM Pools. However, the Safebox model introduced by Flooring has significantly improved the price discovery ability for rare NFT assets, an aspect that Blur has not yet been able to effectively implement.

(Source: https://dune.com/queries/3172383/5295405)

LooksRare & X2Y2 The Gradual Sunset of Trading Mining

In late September this year, LooksRare took the lead in adjusting its tokenomics, bringing an end to its trading mining model that had lasted for more than a year. Starting from October 1st, 50% of the fees generated from the LooksRare Games such as YOLO and Raffles, as well as other upcoming games, are used to buy back LOOKS on the secondary market, 10% is added to the LooksRare protocol rewards for earning, and 40% is sent to the treasury. This means that although trading rewards has ended, LOOKS stakers can still enjoy the platform’s fees and also a 10% fee reward from the LooksRare Games. As of the tokenomics modification announcement on September 29, 1.8 million LOOKS had been bought back into the treasury.

From the results, the end of trading mining on LooksRare led to a sharp decline in the platform’s fake volume (as shown in the left chart below) to nearly zero, while the impact on the real volume (as shown in the right chart below) was relatively limited. On the other hand, looking at the change in the number of traders, there was a significant decline in LooksRare traders at the beginning of August, but after the end of trading mining, the number of traders continued to fluctuate within the same range. This seems to indicate that users who were engaged in trading mining during the late phase (August to end of September) when trading mining was about to end, were retained after the end of trading mining (October). Such a change might reflect that there is a loyal user base on LooksRare, or it could suggest the possibility of the team’s participation in trading activities.

(Source: https://dune.com/hildobby/NFTs?Wash+Trading+Filter_e106ea=)

Although it cannot be completely confirmed how the facts stand, the innovative operational approach of LooksRare Game has created conditions for user retention, such as Yolo integrating gambling elements and Raffles being a lottery with NFT rewards. LooksRare provides tasks for users to participate in these mini-games to meet conditions and earn gems, which can be exchanged for LOOKS. In this process, there will be some tasks related to NFT trading to stimulate the platform’s trading volume. The greater the trading volume or the funds participating in the games, the more gems can be obtained. However, at present, it seems that users are not very willing to spend a lot of money for this.

Another platform, X2Y2, although still retaining trading mining, also announced on the first day of November that the daily token emission would be reduced by 50% starting from November 7th. In April, the author pointed out that LooksRare was more focused on expanding the platform’s functionality, while X2Y2 took the path of external expansion based on a full NFT financial ecosystem. It seems to still be the case now. Along with the token emission reduction, the announcement also included the upcoming launch of a cross-chain aggregator and the claim that the NFT marketplace Dew, which it incubated, has captured 30% of the Polygon NFT market share. Based on the broader NFT ecosystem it aims to build, it is expected that X2Y2’s tokenomics will undergo more adjustments in the future. As the complete token output date for X2Y2 (April 3rd, 2024) gradually approaches, the era of NFT trading mining is also nearing its conclusion.

An interesting aside for X2Y2 is that at the end of September, when Yuga Labs’ Otherside game Legends Of The Mara was launched, other NFT marketplaces were blacklisted for not offering forced royalties, and thus X2Y2 was also selected by Yuga Labs as the official preferred Mara NFT recommendation marketplace. This incident inadvertently gave X2Y2 a unique advantage, but at the same time laid the groundwork for Yuga Labs to create a forced royalty market with contractual constraints.

Multichain and Aggregation

Avoiding the direct competition on Ethereum, platforms that have chosen to follow the multichain or aggregation route have also seen certain development. A leading example of multichain and aggregation is OKX NFT Marketplace, with Magic Eden also at the forefront of the multichain path. Additionally, smaller platforms like Element and Zonic have decent user traffic support on emerging public chains.

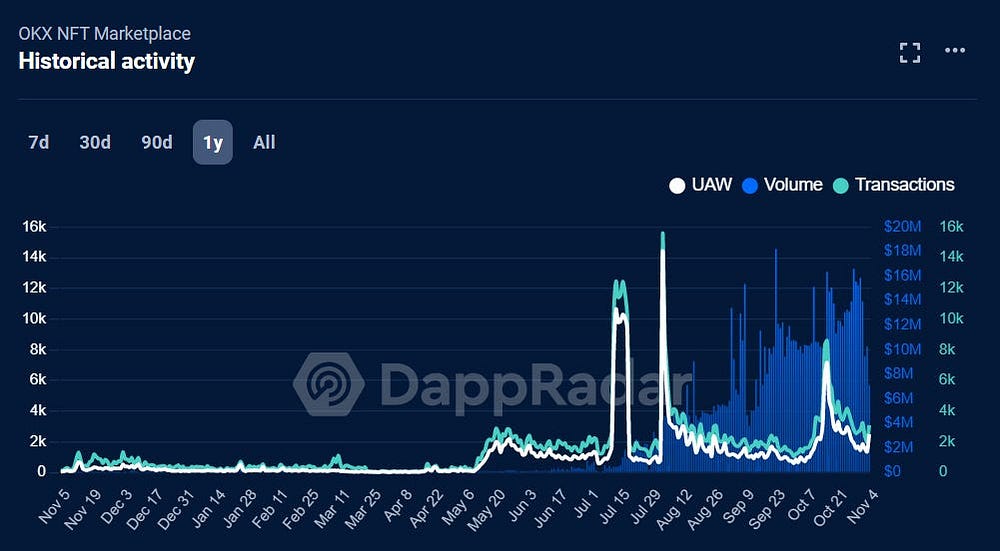

The traffic bonus brought by Web3 wallets integrated within exchanges has finally exploded in the second half of this year, with OKX NFT Marketplace’s volume and user base experiencing explosive growth. Currently, OKX NFT Marketplace supports 17 public blockchains and aggregates liquidity from 6 major trading markets. At present, the daily aggregation volume of OKX NFT Marketplace is between $7 million to $15 million. However, the volume of its own market is still relatively small, indicating that the on-chain user traffic converted by OKX from its CEX has also benefited the liquidity marketplaces it aggregates.

(Source: https://dappradar.com/dapp/okx-nft-marketplace?range-ha=30d)

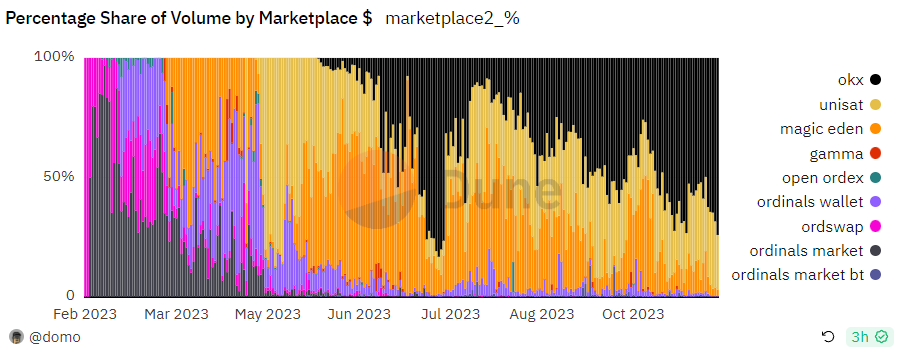

After experiencing the collapse of the Solana ecosystem, Magic Eden’s push into the multichain market is still not to be underestimated. At the end of June, it partnered with Helio to launch a multichain NFT presale platform. In August, it announced a $1 million creator fund on Polygon, and in September, it launched Solana cNFTs. In November, Magic Eden announced a partnership with Yuga Labs to introduce an Ethereum NFT marketplace protected by contract-enforced creator royalties. Basically, every month there is a big action of multichain layout. However, in hindsight, Magic Eden’s announcement in October to suspend BRC-20 trading may not have been a wise decision, and its Ordinals market share dropped from over 50% to less than 5%, with OKX taking its place.

(Source: https://dune.com/domo/ordinals-marketplaces)

The multichain markets Element and Zonic share similar strategies. Against the backdrop of one-click chain launches, they cater to the development of emerging L2s with the shortest time to market, competing for users interested in airdrop hunting. They are among the top in terms of active addresses on various L2s such as zkSync Era, Base, Linea, and Scroll. However, the L2 NFT communities are still in their infancy, contributing limited volumes, and their activity levels are easily influenced by airdrop-related events activities.

(Note: The article from back in April can be found in this thread: https://x.com/defioasis/status/1651123667248758785?s=20)

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish