Editor: Joey, WuBlockchain

This article excerpts a piece from Bloomberg to summarize some key economic data, and from this, makes a subjective judgment about whether the U.S. economy can achieve a soft landing in the next six months.

The article primarily expresses two core viewpoints: first, the data that genuinely reflects economic conditions are Treasury Notes yields, unemployment rates, savings and loans, and oil prices. Second, whether a recession occurs is a non-linear problem. We need to make a distribution prediction for future data, but people deduce conclusions based on a linear thinking logic using the current CPI, PCE, GDP, non-farm employment, and other known data.

Original article link: https://www.bloomberg.com/news/articles/2023-10-01/6-reasons-why-a-us-recession-is-likely-and-coming-soon#xj4y7vzkg

The article lists six statistical data points, analyzing whether the United States can avoid a recession. The data includes “soft landing” calls, Treasury Notes yields, oil prices, unemployment rates, deposits, and loans.

1. Calls for a “Soft Landing”

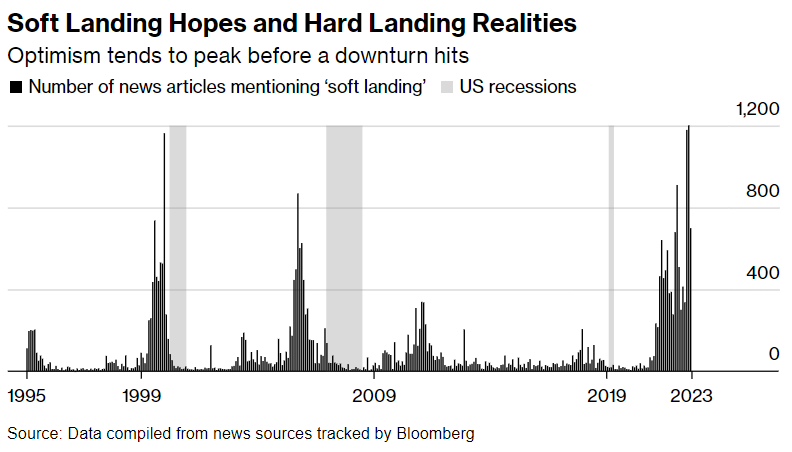

Editor’s note: In the graph, the grey area represents periods of recession, while the bar graph represents occurrences of articles or news about a “soft landing” in the media. Apart from a brief recession in 2020 caused by the sudden pandemic, without much discussion of recession previously in the market, calls for an economic soft landing were quite high before the other two recessions.

Why is it difficult for economists to predict a recession? A significant reason is that people use linear thinking to predict recessions, but recessions are non-linear events.

2. Unemployment Rate

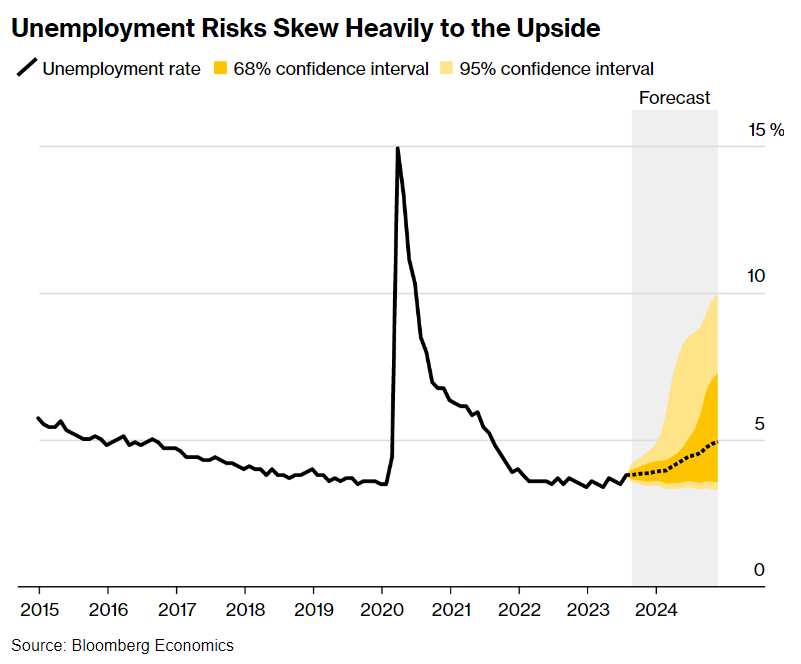

The Federal Reserve’s latest forecast is that the unemployment rate will rise from 3.8% in 2023 to 4.1% in 2024, based on a linear prediction from current data trends, concluding that the U.S. will avoid a recession.

Bloomberg has established a distribution model to predict the unemployment rate.

Editor’s note: In the graph, the dashed line represents the unemployment rate predicted based on the linear model. The dark yellow represents the unemployment rate distribution range under a 68% confidence level, and the light yellow represents the distribution under a 95% confidence level. Therefore, there is about a one-third probability that the unemployment rate will spike to over 7%. This data usually lags 18 to 24 months, meaning the impact of interest rate hikes on unemployment will not manifest until the end of this year or the beginning of 2024.

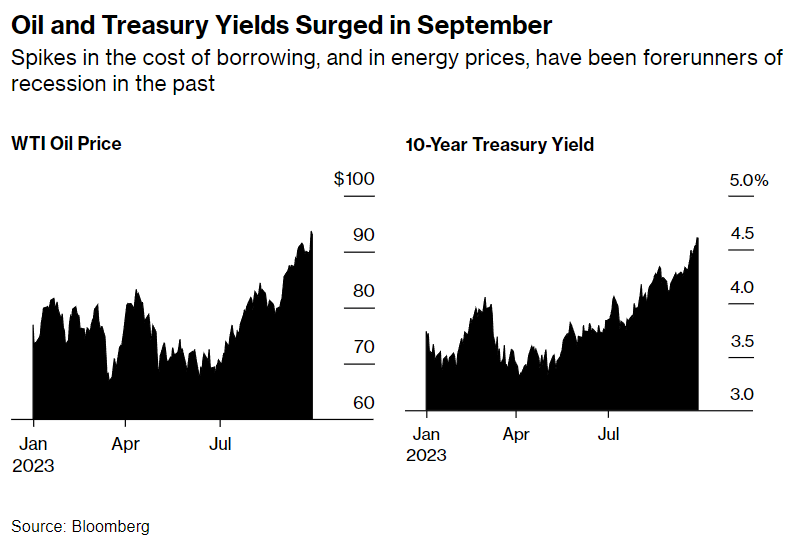

3. Oil Prices and Treasury Notes Yields

Crude oil prices are one of the truly reliable recession warning indicators because rising oil prices suppress resident spending in other discretionary consumption areas. The current oil price has risen nearly 25 USD from the summer’s low, breaking through 95 USD per barrel.

Yield curve: The yield on 10-year Treasury Notes has reached 4.6%, the highest level in 16 years. Long-term higher borrowing costs have already pushed the stock market into a downward channel.

Editor’s note: The left side shows oil prices, the right side shows 10-year Treasury Notes yields. The analysis section below will highlight why a rise in long-term Treasury Notes yields is the most alarming signal.

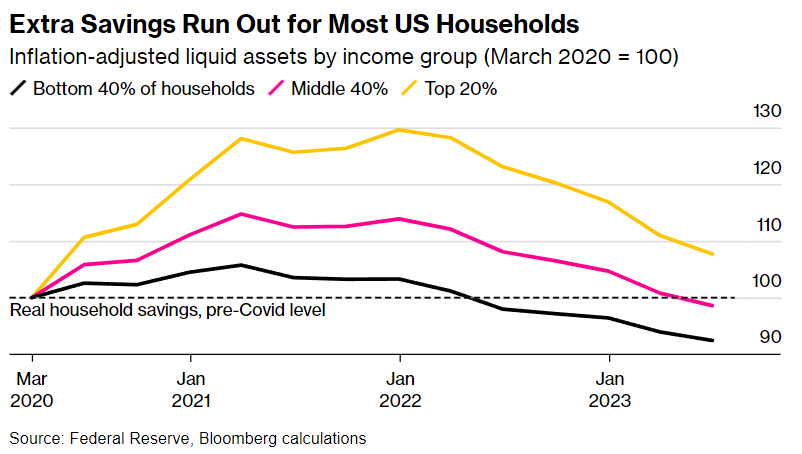

4. Deposits and Loans

The core of the soft landing argument lies in robust household spending. Unfortunately, historical experience shows that consumers typically continue to purchase strongly until the point of recession.

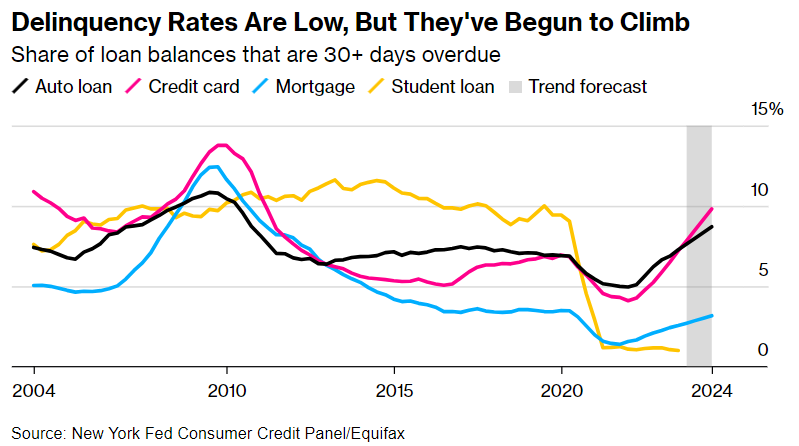

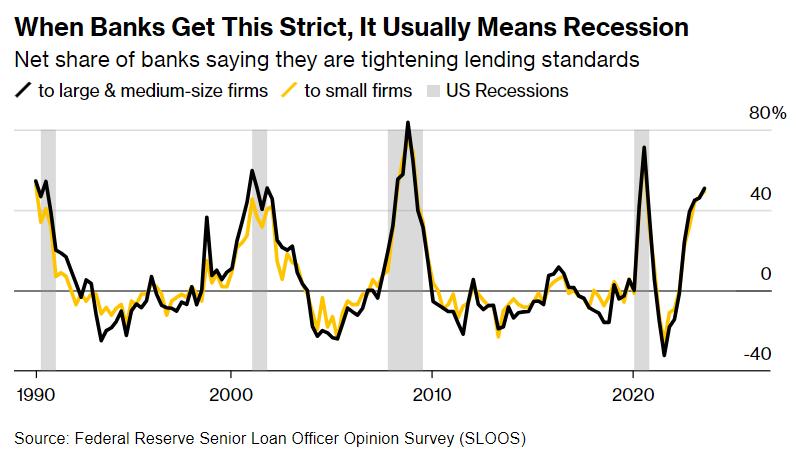

Bloomberg’s calculations indicate that the poorest 80% of the population now have less cash on hand than before Covid, while loan default rates are soaring. Also, according to SLOOS data, about half of large and medium-sized banks are adopting stricter standards for commercial and industrial loans.

Interpretation: Discussing the Inevitability of Recession from Unemployment Rate, Deposits and Loans, and Treasury Notes Yields

1. “Soft Landing” Calls High but Not Supporting the Conclusion of Recession

When discussing whether the United States will enter a recession on social media, an interesting phenomenon arises: optimists claim that if everyone believes a recession is imminent, can it still occur? Pessimists express the same sentiment.

This is a classic confirmation bias. Once you have a predetermined conclusion in mind, you subconsciously seek evidence to support it. Therefore, optimists perceive the general consensus to be that a recession will occur, giving rise to a self-satisfactory sense of being the lone sober in a sea of drunks; the same goes for pessimists.

So, do all believe a recession will occur, or not? I prefer data over sentiment. Bloomberg’s data reveals the current high calls for a “soft landing”.

However, I do not quote this article to assert that overwhelming optimism guarantees an impending recession. Contrarily, I believe that the more optimistic the public, the more beneficial it is for economic recovery. It’s simple logic: this is economics, not the stock market. “Be fearful when others are greedy, and greedy when others are fearful,” applies to stock trading, not economic development. For a consumption-driven country, economic development is highly dependent on public confidence. The more confidence the public has in the future, the more likely consumption will remain robust, and the less likely an economic recession.

Therefore, I disagree with the first set of data in this article. Why do I still believe a recession is on the horizon?

Because what Americans lack now is not confidence, but money!

2. Unemployment Rate, Deposits, and Loans Are the Underlying Logic Leading to Recession

I strongly agree with one point in the article, which is that recession is a non-linear event; we cannot derive a linear conclusion from known data. Optimists believe that strong American consumption, based on current non-farm employment, household spending, etc., will continue until a recession hits, according to historical experience.

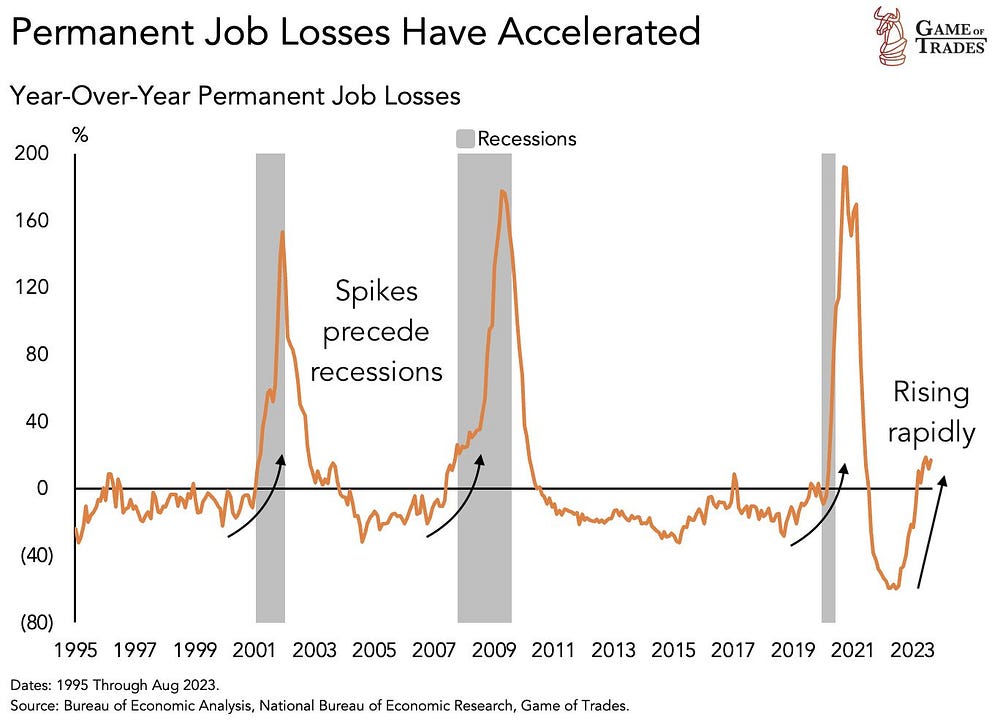

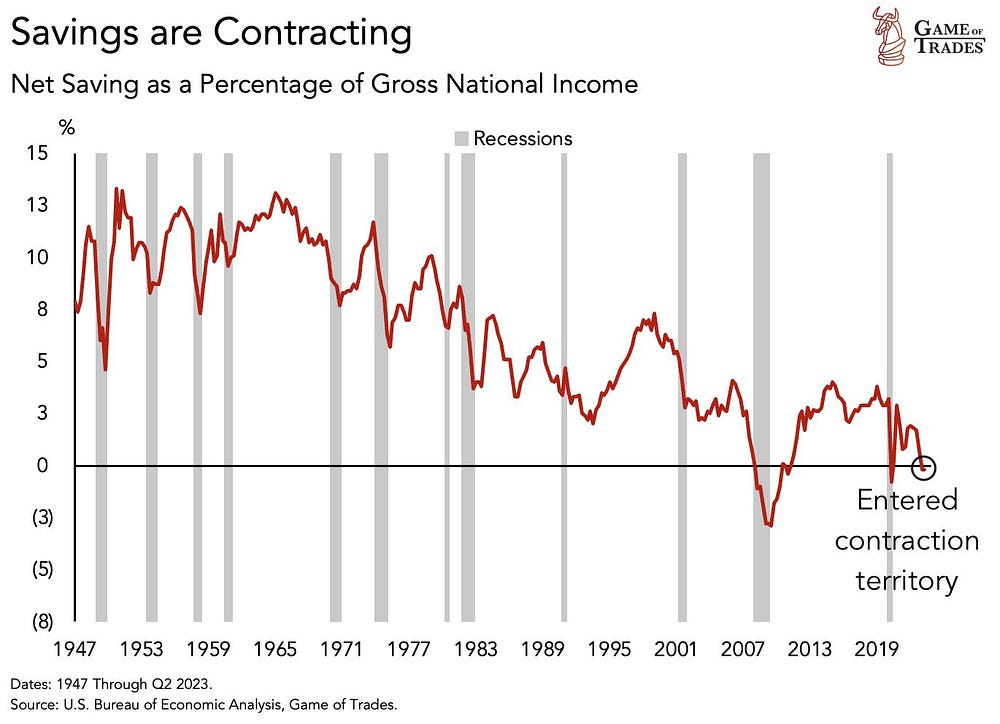

What data can genuinely predict future consumption levels? Unemployment rate, deposits, and loans! Money is either earned, saved, or borrowed. If all three sources are diminishing, why should we believe consumption will remain strong?

This article succinctly clarifies the underlying logic of recession, which I believe is its greatest value. However, the Bloomberg data on unemployment and deposits, presented with a relatively short timeframe, is supplemented by the following graph. Noticeably, the unemployment rate among U.S. residents is beginning to surge sharply, and savings are nearly depleted.

Consumption contributes over 80% to U.S. GDP. Now, 80% of U.S. residents have less cash on hand than before Covid, bank loans are continually tightening, while loan default rates are climbing. Once the unemployment rate begins to rise, a recession will be inevitable.

Moreover, soaring oil prices could well be the final straw for consumers.

3. Treasury Notes Yields

The yield spread between 10-year and 2-year Treasury Notes is a famous leading indicator of recession, albeit its underlying logic is not as intuitive as unemployment data, etc. Also, being a leading indicator, typically, the U.S. economy remains robust when the yield curve inverts, often continuing until the inversion ends. That’s why people tend to forget historical lessons and think “this time is different” every time an inversion is about to conclude.

This time is no different. The inversion occurred in April and July 2022 (a brief inversion in April, but a long-term inversion from July onwards), lasting for over a year. Consequently, the current concerns about inverted yields in the market are not as high as a year ago, and people begin to believe this time is different.

However, the truth is, not only is the economic situation during this inversion reversal no better than in the past, it is even worse.

The U.S.’s current fiscal situation is deteriorating, with the fiscal deficit reaching $1.5 trillion in the first 11 months of the 2023 fiscal year, a 61% YoY increase. Thus, continued bond issuance is inevitable. After relaxing the debt ceiling in early June, the U.S. Treasury increased the debt by $1.7 trillion in just four months. By October, the total debt of the federal government has exceeded $32 trillion (including debt held internally), with the annual increase over $2 trillion.

The debt volume is far from comparable to that of 2008, and the two major U.S. debt holders at that time — Japan and China — may now either lack the ability or the willingness to undertake such massive debt. Therefore, the U.S. debt market currently lacks buyers, resulting in a slide in Treasury Notes prices and a rise in Treasury Notes yields. This is why we have seen the yield on 10-year Treasury Notes rise continuously since July, causing the long-short term interest rate spread to turn upward.

My belief that the context of this yield curve inversion resolution is worse is because, historically, such resolutions were achieved by lowering short-term bond yields, i.e., reducing interest rates. As soon as the Federal Reserve initiates rate cuts, short-term bond yields would promptly head downward. This method at least stimulates economic recovery. Although a recession still eventually occurs, at least it doesn’t last very long.

However, this time the inversion is resolved by raising long-term bond yields. The long-term bond yield reflects the market’s long-term expectations for U.S. interest rates, and its upward trend implies that market expectations for the Federal Reserve maintaining high interest rates long-term are heating up. In economics, the 10-year Treasury Notes yield is often regarded as an anchor for asset prices, serving a “denominator” role in asset valuation processes, so its rise necessarily triggers a decline in other asset valuations. Since July, its soaring trend has triggered a series of downward trends in the stock and currency markets. If the market expects the Federal Reserve to maintain high interest rates in the long term, this downward trend is likely hard to stop.

More crucially, long-term bond yields represent the degree of U.S. debt risk. The soaring long-term bond yields indicate that the possibility of U.S. debt default is sharply rising.

To reduce long-term bond yields, more buyers must be found. There are essentially two ways to increase buyers: one is to continue maintaining high interest rates to attract more funds to buy government bonds; the other is to expand the balance sheet, accelerate money printing, and continue to borrow new debt to repay old debt.

If the second method is chosen, it is akin to quenching thirst with poison, and the additional scale this year is highly likely to exceed 2 trillion, equivalent to an increase of 6.5% in the total debt scale. If this continues, the scale of debt will exponentially skyrocket. The ultimate result is that no economy can undertake it, and all that can be done is to watch it spiral upward until debt defaults occur.

This is also why I think the Federal Reserve will not lower interest rates in the short term because maintaining high interest rates is the only way to possibly attract more funds to buy government bonds without further pushing up the scale of debt, thereby avoiding debt default. Debt stability and dollar stability are intimately linked; once the debt collapses, the dollar loses its credit foundation, and once the dollar collapses, the very essence of the U.S. will be shaken.

When it comes to issues affecting the very essence of the country, an economic recession doesn’t seem so important. After all, it’s not the first or second time the U.S. has faced a recession; it’s just that this time it might last a bit longer.

In summary

This text, using a Bloomberg article, focuses on elaborating four data points I believe can effectively predict future economic conditions: unemployment rate, deposits, loans, and U.S. bond yields.

Of these, the unemployment rate and deposit-loan ratio predict future consumption status. Since consumption accounts for 80% of the U.S. GDP contribution. Currently, the level of deposits by U.S. residents has dropped to pre-pandemic levels, second only to 2007. The credit card default rate and the degree of bank credit tightening have also reached the highest levels since 2007. Most crucially, unemployment rate data has started to turn upwards.

Therefore, a sharp drop in U.S. household spending in the next year is highly probable.

Finally, it is speculated that the Federal Reserve will not likely lower interest rates in the short term, based on the current U.S. debt situation, thereby concluding that not only is a recession inevitable, its duration might be longer than the previous instances.

This poses a significant test for global risk assets. The high calls for a “soft landing” reveal that risk expectations have not been priced in.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish