Source: https://mirror.xyz/lokiz.eth/w1WKevEM3AAHaS-eDXIiRPU0DtzY6TCiQ_a8eX3tlIA

I. How to Create a Successful Ponzi Social Product

The Friend.tech economic model seems straightforward:

1. The Key price increases with quantity.

2. A 10% transaction fee is charged, shared equally between the protocol and Key issuer.

3. Points are distributed to users over the next 6 months.

Understanding the economic model is best done by putting yourself in the shoes of the project team: “If I were designing the economic model, how would I do it?” The starting point is to create a SocialFi product, but past experiences and the current market’s liquidity condition make optimism difficult. Thus, you aim to create a product with some Ponzi attributes to jumpstart it.

(1) What Does (S²) / 16000 Mean?

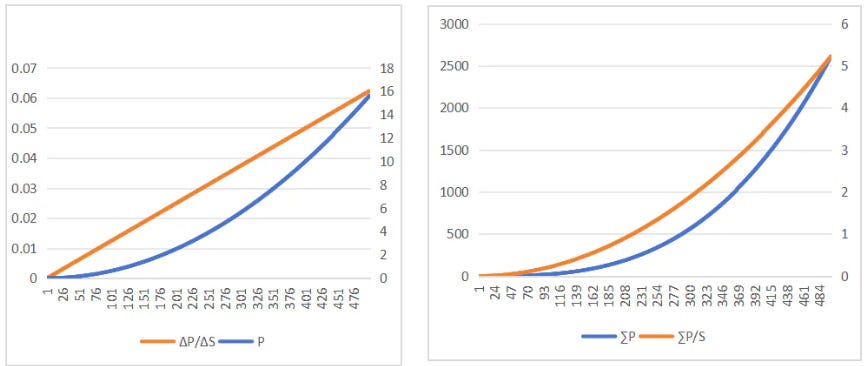

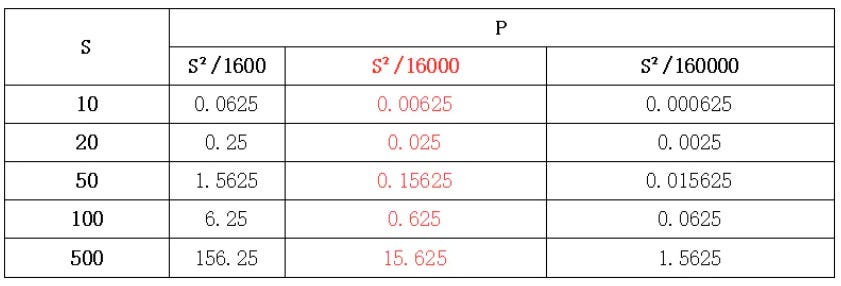

The core of Ponzi is to let early entrants profit. Consider that all users enter one by one; considering S can only be an integer, we should use differences and sums. It can be seen that ΔP/ΔS is linearly increasing, ensuring that as the number of Keys grows, the Key price will increase, and the rate of increase will also accelerate.

This is an indirect and efficient Ponzi curve where each entrant drives up the price, and the magnitude of the push increases over time. As for the value 16000, it’s a parameter that creates a market-matching relationship between S and P. If it’s smaller, the P curve becomes too steep with excessive price fluctuations; if larger, the price curve becomes too flat, not Ponzi enough. 16000 is a compromise, and a smaller capacity aligns with the current market liquidity conditions.

(2) How Does the Economy Cycle?

Optimists see Friend.tech as a social platform, while pessimists see it as a gambling platform. Both understandings have three roles:

1. FT platform

2. Key issuer

3. users

The only profit-generating action is user transactions (also a precondition for use/holding).

So the question becomes: How to attract users to buy? Under the social platform understanding, the Key issuer is a service provider (regardless of the service), and the platform provides basic services. Under the gambling platform understanding, the Key issuer acts as a bookmaker, responsible for attracting users.

This revenue-sharing model is also simple and efficient. The 50% split equates to KOL service procurement, which many KOLs accept. The Ponzi model addresses the cold start issue here, as in the initial stage, the services offered by Key issuers are likely to be inconsistent and unstable. Speculative demand can serve as a substitute at this time.

(3) Point Airdrops

Airdrops serve to further stimulate demand and blur the lines between users’ speculative, usage, and investment demands.

II. How Much Is the Transaction Friction?

Friend.tech’s economic model and narrative are elegant, but based on my experience, I decided to abandon my Room because it’s a very draining and negative-sum game.

First, ask: What is the transaction cost of a Key? 10% is obviously an incorrect answer.

Consider this scenario: You hold 1.1 ETH entering this market. Since buying also incurs a 10% fee, you can only buy 1 Key worth 1 ETH. At this point, your Room’s Value is 1 ETH. But no matter when you sell, you’ll incur another 10% fee, so your actual liquidation value = 0.9 ETH. From the moment you bought, the 10% transaction fee was unavoidable, and you’ve already lost 19.2%, needing a 22% increase to break even.

19.2% is not hard to calculate, but sadly, this is Friend.tech’s second red herring.

Understanding the relationship between Book Value (BV) and Expected Value (EV), when all Key buyers are speculators:

(1) Alice,Bob, and Cora pool their money to buy a cow, a duck, and an egg. They agree that the first one to exit takes the cow, the second takes the duck, and the last takes the egg.

(2) Alice,Bob, and Cora all believe they have the right to the cow, but in reality, their rights are equal. There are six possible outcomes, and they each take one of these outcomes: 1) cow, duck, egg; 2) cow, egg, duck; 3) egg, duck, cow; 4) egg, cow, duck; 5) duck, cow, egg; 6) duck, egg, cow.

(3) Due to the equal probability of these six outcomes, Alice’s true ownership is 1/3 cow, 1/3 duck, 1/3 egg.

Through this example, it’s evident that although Alice,Bob, and Cora all believe they have the right to the cow, it’s an illusion. Their true ownership value should be the mathematical expectation of their rights (EV) summed up. If a new player, David, joins this game, he needs to provide a set of houses. When he joins, the houses are divided into four parts, with Alice,Bob, and Cora each getting 1/4.

It’s clear that each new entrant dilutes the EV of previous holders. This is the core of Friend.tech:

1. Confuse BV and EV to create a wealth illusion;

2. Use the EV of later participants to provide profit to earlier users.

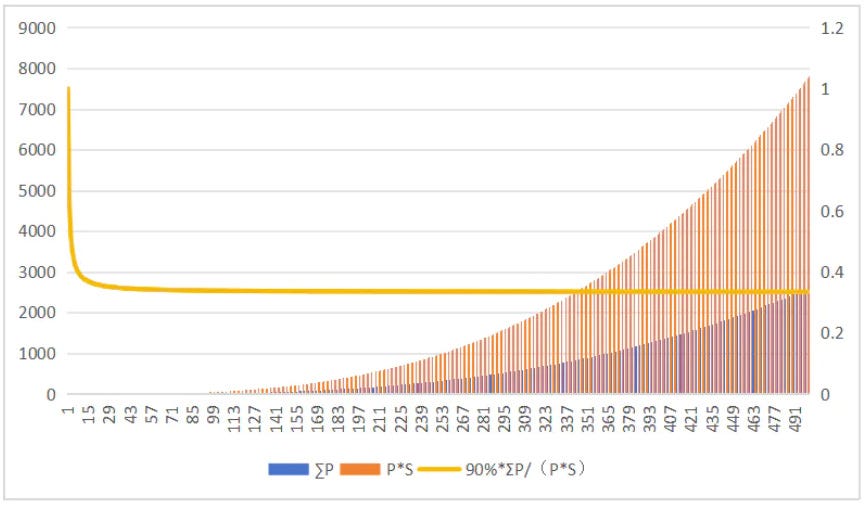

Friend.tech’s trading mode is that the pool is the only counterparty, so the funds available for trading are TVL in the pool, which will cause differences. For example, when the number of keys is 40, the price of keys is 0.1E, the total market value = 400.1E=4E, and TVL=ΣP=1.38E. With this in mind, we can plot a curve of the relationship between book value (BV) and EV (yellow line chart in the figure).

It can be seen that when the number of keys exceeds about 20, EV/BV is basically stable at around 30%, infinitely close to 30%. There are two implied messages here:

1. If you buy in the flat part of the curve, in addition to paying a 10% fee +10% forward fee, you will immediately lose about 70% of your EV.

2. The Room Value shown by FT is too optimistic. Based on the principle of caution, it is more scientific to measure the Value of the Key you hold with Room value *~30% (EV).

This also explains why everyone seems to have made at least 2–3 times paper returns over the past period of time.

III. Where Does the Growth End?

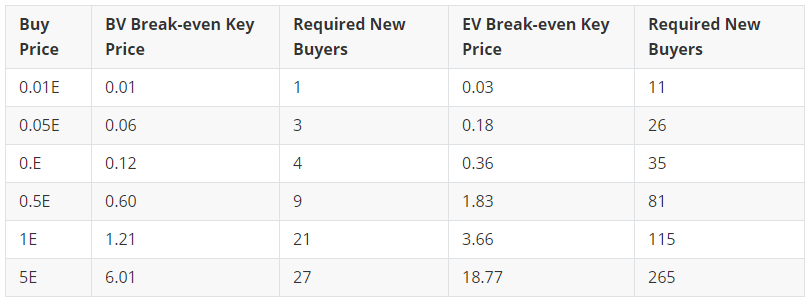

Next, consider the “break-even” question. Assuming all users join for profit, breaking even isn’t difficult when using BV as a criterion. Even if you buy at 5E, you only need 27 new buyers to make your money back.

But from an EV perspective, buying high-priced Keys almost impossible. For example, buying a 1 ETH Key would require 115 new buyers to break even.It is natural to use book value as a recovery factor when the number of protocol datas and users grows, but this measurement becomes unreliable when growth stops or declines.

At the same time, whether according to book value or according to EV calculation, there is the same problem, the higher the purchase price, the number of new buyers will increase.Growth has limits, and if the limit is N, buyers after N-M can’t break even. This leads to a cycle where rational players won’t buy after N-M, causing the equilibrium price to continually drop.

In reality, this situation is one of the classic cases in game theory — the “2/3 Game.” If you find this process challenging to understand, you can refer to explanations of the “2/3 Game” in game theory.

To put it more directly, after net inflows slow, high-value keys become unprofitable at first, and speculators will seek out cheaper keys, and the cycle will continue, with the price of individual keys (especially new keys) moving down the top. Under normal circumstances, such downward movement will not be a big problem, but another problem is that Friend.tech bots are very abundant, bots will monopolize the low price area of the new market, so after the new equilibrium price moves down, they will directly enter the arbitrage range of bots, and the EV of users will be further eroded.

IV. Is (3,3) Reliable?

The next issue to discuss is whether (3,3) is reliable. The answer is no for several reasons:

1. (3,3) is often asymmetric. For example, if you buy a 3 ETH Key while your own Key is priced at 0.1 ETH, your purchase contributes 0.15 ETH in fees, while the other party contributes only 0.005 ETH.

2. The (3,3) model among multiple participants is extremely unstable. With more people, it becomes highly unstable. When there are only two participants, it’s stable, similar to a prisoner’s dilemma. But as more join, it becomes very unstable, following the principles of evolutionary game theory.

This is another classic model in game theory — the evolutionary game model. The derivation of the evolutionary game model is very complex and tedious. In simple terms, when there are a sufficient number of participants, there will always be someone trying to get ahead by changing their strategy because it is profitable. If A’s attempt to get ahead results in a loss for B, then B’s motivation to get ahead and lock in gains/avoid losses increases, and there will also be mutual suspicion among C, D, and E because the EV is much lower than the BV. Once the chain of suspicion forms, the only Nash equilibrium is (-3, -3).

It’s important to note that in the past, the (3, 3) seemed stable over short periods, but this was mainly because during bullish cycles, people tend to overlook the issue of EV exploitation and the tendency towards (-3) becomes less frequent during growth. These observations mainly apply to multi-party (3, 3) among strangers. If you and your friends are involved, or if there is an agreement for (3, 3), it tends to be more stable because choosing the (-3) strategy would incur additional reputation loss.

V. Is Point Farming Profitable?

First, it’s important to note that current estimates of farming profits are based on estimated FDV. When devising your strategy, the real EV = estimated returns based on FDV * probability of actual airdrops * (1 — attrition rate) (e.g., due to linear vesting, prices not meeting expectations, etc.).

From my own experience and that of other friends, Friend.tech’s points have two characteristics:

1.The points of the vast majority of users are ultimately related only to the holding value, and there is a snapshot time point before distribution, taking only the holding value at that time.

2.As mentioned earlier, the book value of Keys is approximately three times TVL. Therefore, when calculating the total funds invested, you need to use TVL * 3 as the baseline for all users’ farming points.

After understanding all of Friend.tech’s mechanisms, the best strategy if you still want to farm is to buy and hold the Key for your other accounts all at once. This approach can avoid EV exploitation and reduce the 5% fee. However, it’s important to note that the least frictional way is to go all-in on your secondary account’s Key and sell it after 6 months. This way, your total opportunity cost = total invested funds * 0.905, resulting in a loss of 9.5% of your capital. But in the following 6 months, it’s best to avoid any further transactions to avoid additional friction.

VI. The Future of FT

All the discussions above are based on the assumption that all participants are speculators, but that’s not the case. Many Room owners have started providing differentiated services through Rooms, and these genuine “services” are the key to Friend.tech breaking free from the Ponzi cycle.

Using the example of Alice,Bob, and Cora buying a cow, duck, and egg: if Alice promises to exit the game last, thenBob and Cora’s EV changes from 1/3 cow + 1/3 duck + 1/3 egg to 1/2 cow + 1/2 duck, significantly increasing their EV. IfBob also promises to exit last, then Cora’s EV becomes a complete cow.

The core of this change is that utility demanders will change the situation of “homogeneous claims,” thereby increasing the EV of the remaining participants. In the actual Friend.tech context, there are two categories:

1. Issuers who hold their Keys and have binding (3, 3) agreements (e.g., ETFs).

2. Users who have both usage and holding demands for Keys, such as those who want to establish contact with Key issuers through Rooms, access Alpha information through Rooms, enjoy real-world benefits, and participate in potential redistributed airdrops.

Key’s utility will determine its utility value and the stability of Key, becoming a junior-level homogeneous claim; while speculative demand will only bring about homogeneous priority claims, which are more unstable and vulnerable to price fluctuations. It can be expected that there will be a clear differentiation in Key’s future, and it will be difficult for (3, 3) and purely speculative Keys to continue to thrive.

VII. High Fees + Bots Are Killing the Game

Considering utility demand, Friend.tech’s business model has the potential to move away from being a Ponzi scheme. However, I decided to sell all my Keys and stop operating my Room last week because Friend.tech’s high fees and bots are killing the game.

On one hand, Friend.tech charges a (5% + 5%) * 2 = 20% fee, while even another high-friction marketplace like Opensea only charges a unilateral 2.5% royalty fee + 2.5% fee, a difference of four times. Data shows that the current TVL of Friend.tech is approximately $36 million, and the fees collected have reached an astonishing $24 million; of which, the protocol has collected $12 million in fees.

According to our previous calculation, $36 million corresponds to an estimated total market value of approximately $110 million, which is not an exaggeration. But even without considering net withdrawals by users and bots, the minimum friction scenario results in $48 million entering this market. After less than 2 months of trading, $12 million already belongs to Friend.tech, accounting for 25%.

At the same time, when these Keys are sold, they will be subject to another 10% fee, which is actually deferred but will be collected. Additionally, based on a total Key market value of $110 million, if these Keys have a daily turnover rate of 5%, Friend.tech will extract $16.5 million per month, approximately 45% of TVL. The net contributions of all users will continually flow to Friend.tech.

The argument that “charging high fees encourages holding” currently doesn’t hold up, as encouraging holding doesn’t require imposing a 10% tax on buyers. Furthermore, from recent updates (adding a web version, adding a watch list) and point rules (the prerequisite for Room Value is buying), Friend.tech does not seem to substantially encourage holding behavior, especially considering who can resist a continuous stream of real protocol revenue?

However, it’s important to note that Friend.tech’s product design, economic model, and operational strategy are all excellent and worth learning from. Social is also one of the deterministic directions of Web3. If Friend.tech can reduce the fee to a relatively reasonable level (or mostly use it for building rather than buying mansions) and address the issue of rampant bots, I believe I would become one of its most loyal users.

Also, my own Keys have no value, and the Room will not be operated. If you want to get in touch with me or have questions to discuss, my Twitter DMs are open to everyone (and you don’t need to hold Keys). If you find my content valuable, feel free to go to my Mirror (https://mirror.xyz/lokiz.eth) to mint NFTs of my articles (including this one). They are limited in quantity (and may have utility in the future) and are reasonably priced (0.001–0.01 ETH, or even free).

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish