WuBlockchain editor: Colin Wu

1. Bitcoin purchase history

On December 9, 2020, MicroStrategy purchased 29,646 bitcoins for approximately 650 million US dollars, at an average price of around 21,925 US dollars. At this point, MicroStrategy held a total of 70,470 bitcoins, with a total cost of approximately 1.125 billion US dollars and an average purchase price of around 15,964 US dollars.

On February 17, 2021, MicroStrategy purchased 19,452 bitcoins for approximately 1.026 billion US dollars, at an average price of around 52,765 US dollars. At this point, MicroStrategy held a total of 90,531 bitcoins, with a total cost of approximately 2.171 billion US dollars and an average purchase price of around 23,985 US dollars.

On June 8, 2021, MicroStrategy purchased 13,005 bitcoins for approximately 489 million US dollars, at an average price of around 37,617 US dollars. At this point, MicroStrategy held a total of 105,085 bitcoins, with a total cost of approximately 2.741 billion US dollars and an average purchase price of around 26,080 US dollars.

On June 14, 2021, MicroStrategy signed a public market sale agreement with agent Jefferies LLC, which would issue common stock with a total value of no more than 1 billion US dollars from time to time. At this point, MicroStrategy held a total of 114,042 bitcoins, with a total cost of approximately 3.16 billion US dollars and an average purchase price of around 27,713 US dollars.

On December 9, 2021, MicroStrategy announced that it had purchased an additional 8,436 bitcoins in the fourth quarter for a total cost of 496 million US dollars, at an average price of approximately 58,748 US dollars. At this point, MicroStrategy held a total of 122,478 bitcoins, with a total cost of approximately 3.66 billion US dollars and an average purchase price of around 29,861 US dollars.

On December 30, 2021, MicroStrategy announced that it had purchased an additional 1,914 bitcoins for approximately 94.2 million US dollars, at an average price of 49,229 US dollars. At this point, MicroStrategy held a total of 124,391 bitcoins, with a total cost of approximately 3.75 billion US dollars and an average purchase price of around 30,159 US dollars.

From December 31, 2021 to January 31, 2022, MicroStrategy purchased 660 bitcoins for 25 million US dollars, at an average price of 37,865 US dollars. The company currently holds 125,051 bitcoins, with an average price of 30,200 US dollars.

On June 29, 2022, MicroStrategy announced that it had purchased an additional 480 bitcoins for approximately 10 million US dollars, at an average price of 20,817 US dollars. At this point, MicroStrategy held a total of 129,699 bitcoins, with a total value of 3.98 billion US dollars and an average purchase price of around 30,664 US dollars.

Between August 2 and September 19, 2022, MicroStrategy acquired approximately 301 bitcoins for approximately 6 million US dollars, at an average price of 19,851 US dollars. At this point, MicroStrategy held a total of 130,000 bitcoins, with an average purchase price of 30,639 US dollars and a total cost of 3.98 billion US dollars.

Between November 1, 2022 and December 24, 2022, MicroStrategy purchased 2,500 Bitcoins, bringing its total holdings to 132,500 Bitcoins for a total purchase price of approximately $4.03 billion, or an average of approximately $30,397 per Bitcoin.

Between February 16, 2023 and March 23, 2023, MicroStrategy purchased 6,455 Bitcoins for approximately $150 million at an average price of approximately $23,238. This brings MicroStrategy’s total holdings to approximately 138,955 bitcoins at an average purchase price of approximately $29,817.

On April 4, 2023, MicroStrategy purchased another 1045 bitcoins at an average price of $28,016, for a total of $29.3 million. MicroStrategy now holds 140,000 Bitcoins at an average purchase price of $29,803, or approximately $4.17 billion.

2. Debt Status

As of March 2023, Microstrategy had approximately $2.2 billion in long-term debt, broken down as follows:

2025 Convertible Notes

On December 9, 2020, MicroStrategy announced the issuance of $650 million in convertible senior notes, including $550 million in convertible bonds and $100 million in options, with a conversion date of December 15, 2025. The convertible bonds have a coupon rate of 0.75% and pay interest semi-annually. The conversion price is approximately $397.99 per share, representing a premium of approximately 37.5% over the closing price of the common stock of $289.45 on December 8. Unless a “fundamental change” defined in the contract occurs, the notes cannot be converted into stock before June 15, 2025. A fundamental change is defined as the company no longer being listed on the NASDAQ or the New York Stock Exchange, being merged or acquired, or undergoing a majority change in ownership. If any of these events occur, Microstrategy may be required to repay the loans in full. Given that CEO Michael Saylor owns over two-thirds of the voting rights, this possibility is unlikely.

2027 Convertible Notes

On February 17, 2021, MicroStrategy again announced the issuance of $1.05 billion in convertible senior notes, including $900 million in interest-free convertible bonds and $150 million in options, with a conversion date of December 15, 2027. The conversion price is approximately $1,432.46 per share, representing a premium of approximately 50% over the closing price of the common stock of $955.00 on December 8. These notes cannot be redeemed before August 15, 2026, unless a “fundamental change” as described in the contract occurs, which is the same as in the 2025 convertible notes.

2028 Senior Secured Notes

On June 8, 2021, MicroStrategy announced the issuance of $500 million in junk bonds due in 2028, with a coupon rate of 6.125% and interest paid semi-annually, requiring a payment of $15.3125 million per year on June 15 and December 15.

2025 Mortgage Loan (partially repaid)

On March 29, 2022, MicroStrategy’s subsidiary MacroStrategy announced a $205 million Bitcoin mortgage loan with Silvergate Bank to purchase Bitcoin, maintaining a collateral ratio of 200%, requiring $410 million to be maintained as collateral, which would only be liquidated if the price falls below $4,000.

Debt Repayment

According to documents submitted to the SEC by MicroStrategy, since September 2022, the company has sold 218,575 shares of Class A common stock for a total revenue of approximately $46.6 million, as part of an agreement with underwriter Cowen and Company to sell up to $500 million in common stock. The net proceeds from this offering are planned for general corporate purposes, including the acquisition of Bitcoin and working capital, and to repurchase the 0.750% convertible senior notes due in 2025 and the 0% convertible senior notes due in 2027, depending on market conditions, and to repay debt to Silvergate Bank.

On March 24, 2023, MacroStrategy and Silvergate signed an agreement, and MicroStrategy repaid its $205 million loan at a 22% discount, prepaying approximately $161 million and reclaiming the 34,619 Bitcoin that had been pledged as collateral.

3. Financial Health

In summary, as of now, MicroStrategy holds 140,000 Bitcoins with an average cost of $29,803. They have a long-term debt of around $2.2 billion with an annual interest of less than $50 million (total interest for 2022 is $53 million, but they have already paid back some, so the interest expense for this year will be lower than last year).

Of the four debts, the convertible notes due in 2025 and 2027 (totaling $1.7 billion) only paid back around $46.6 million. The mortgage loan due in 2025 (totaling $205 million) has already paid back at least $161 million, and the junk bond due in 2028 is still outstanding.

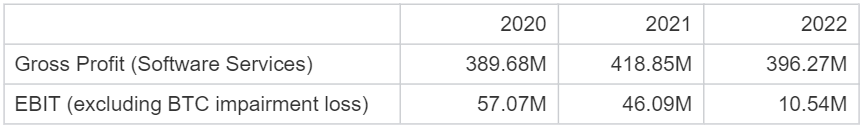

MicroStrategy’s 2022 annual report shows that their full-year earnings before interest and taxes (EBIT) were -$1.276 billion, including impairment losses on digital assets (excluding sales revenue) of $1.286 billion. If we exclude this loss, the EBIT would be $10.54 million (with Q4 being $3.91 million), a significant decrease from $46.09 million in 2021. This shows that relying solely on operating income is insufficient to cover the annual interest. However, the company currently holds nearly $43.84 million in cash and cash equivalents, so they will not face a debt crisis at least until 2023.

Furthermore, even if the company cannot pay the interest, they can sell a small amount of Bitcoin or company equity. On December 22, 2022, MacroStrategy sold around 704 Bitcoins at an average price of about $16,776, receiving approximately $11.8 million in cash. This was the first time they sold Bitcoin after adding it to their balance sheet and could result in tax benefits. This shows that selling a small amount of Bitcoin to pay interest is not impossible. Assuming that Bitcoin stays at around $15,500 for the next two years, they would only need to sell 3,400 Bitcoins in 2024 to pay the interest. Therefore, there is almost no possibility of MicroStrategy going bankrupt before the debt matures, and as long as the price of Bitcoin reaches around $30,000 before March 2025, they can achieve a basic break-even point (currently at a break-even point).

Note: Recently, the Financial Accounting Standards Board (FASB) proposed new standards for cryptocurrency assets, suggesting that they should be measured at fair value. The current accounting standards follow Generally Accepted Accounting Principles (GAAP) in the US, which treats cryptocurrency assets as “indefinite-lived intangible assets” and requires impairment reserves to be set aside when their value decreases, with losses reported on the income statement, and subsequent reversals of impairment losses prohibited. In other words, the company can only report the decline in the value of its cryptocurrency assets and not the increase until they sell them. This is based on the conservatism principle but does not reflect the true value of cryptocurrency assets.

If the FASB’s proposal is approved, cryptocurrency assets will be measured based on their market price, which will significantly increase MacroStrategy’s net profit on paper with the price increasing. This article also deducts impairment losses on cryptocurrency assets when calculating EBIT.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish